Have you ever wondered how to organize your finances effectively? Creating a 4 column chart of accounts can be a game-changer in managing your money efficiently. This simple tool can help you track your income, expenses, assets, and liabilities seamlessly.

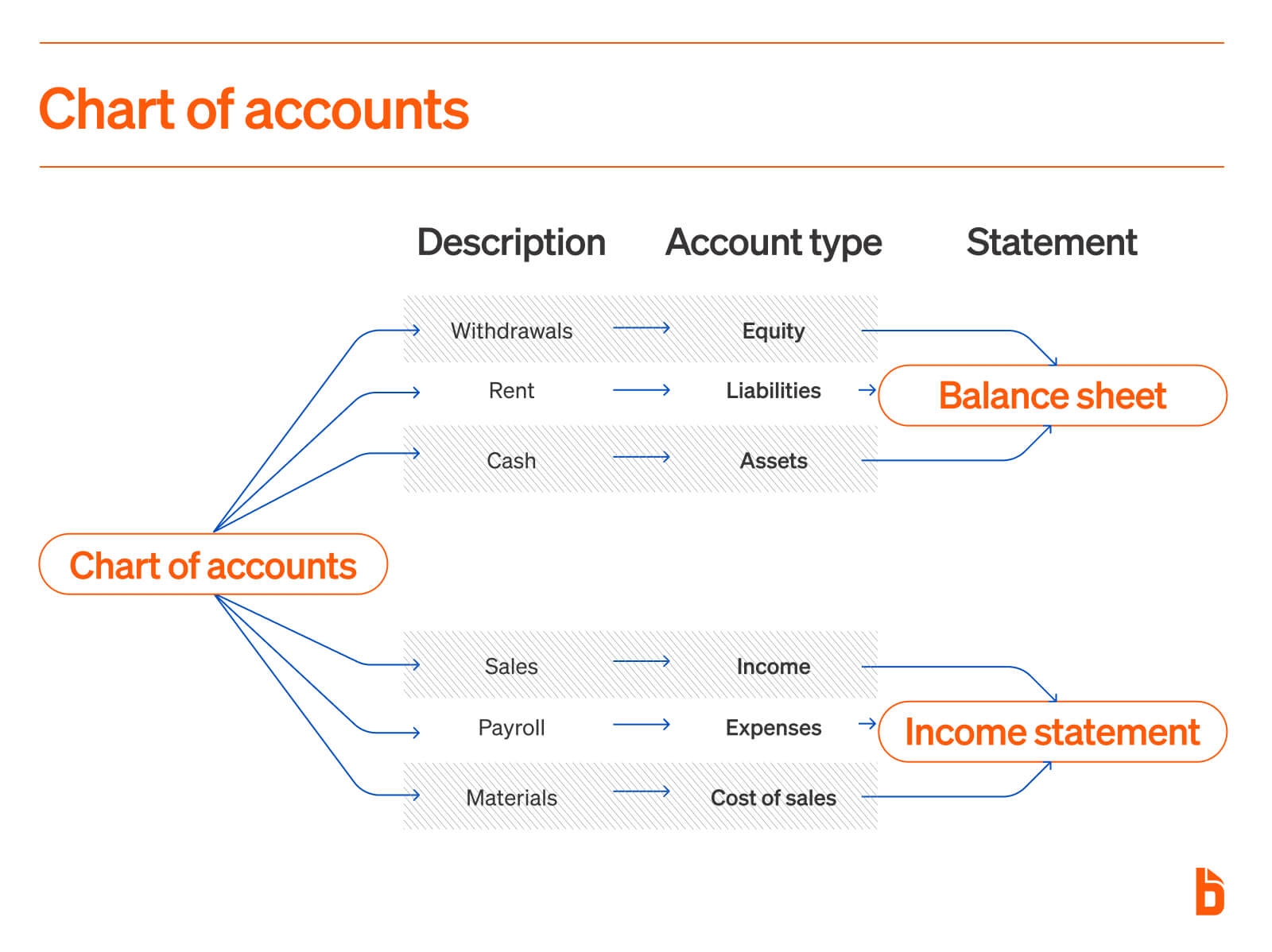

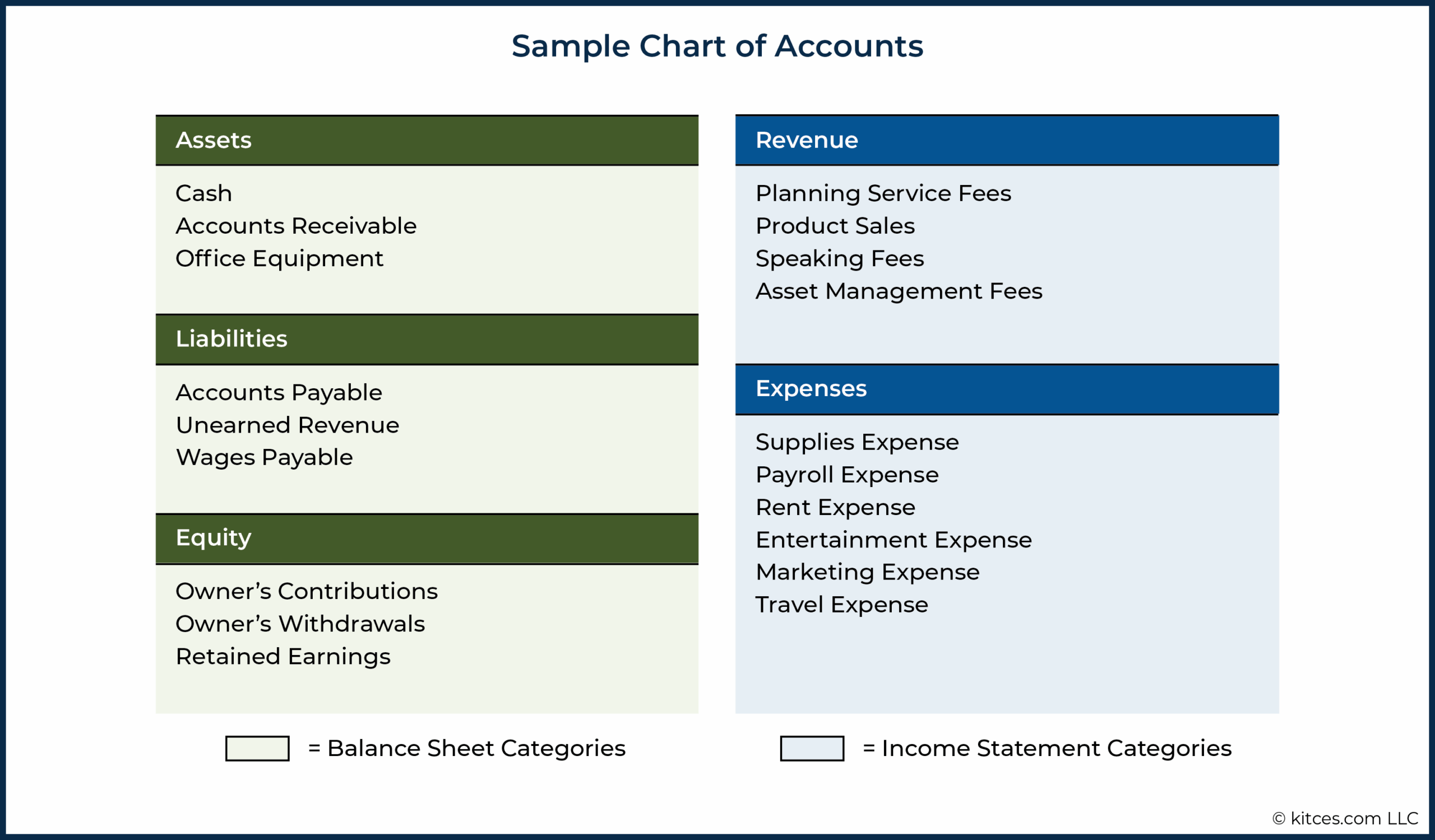

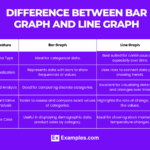

By using a 4 column chart of accounts, you can categorize your financial transactions into four main groups: income, expenses, assets, and liabilities. This system allows you to have a clear overview of where your money is coming from and where it is going.

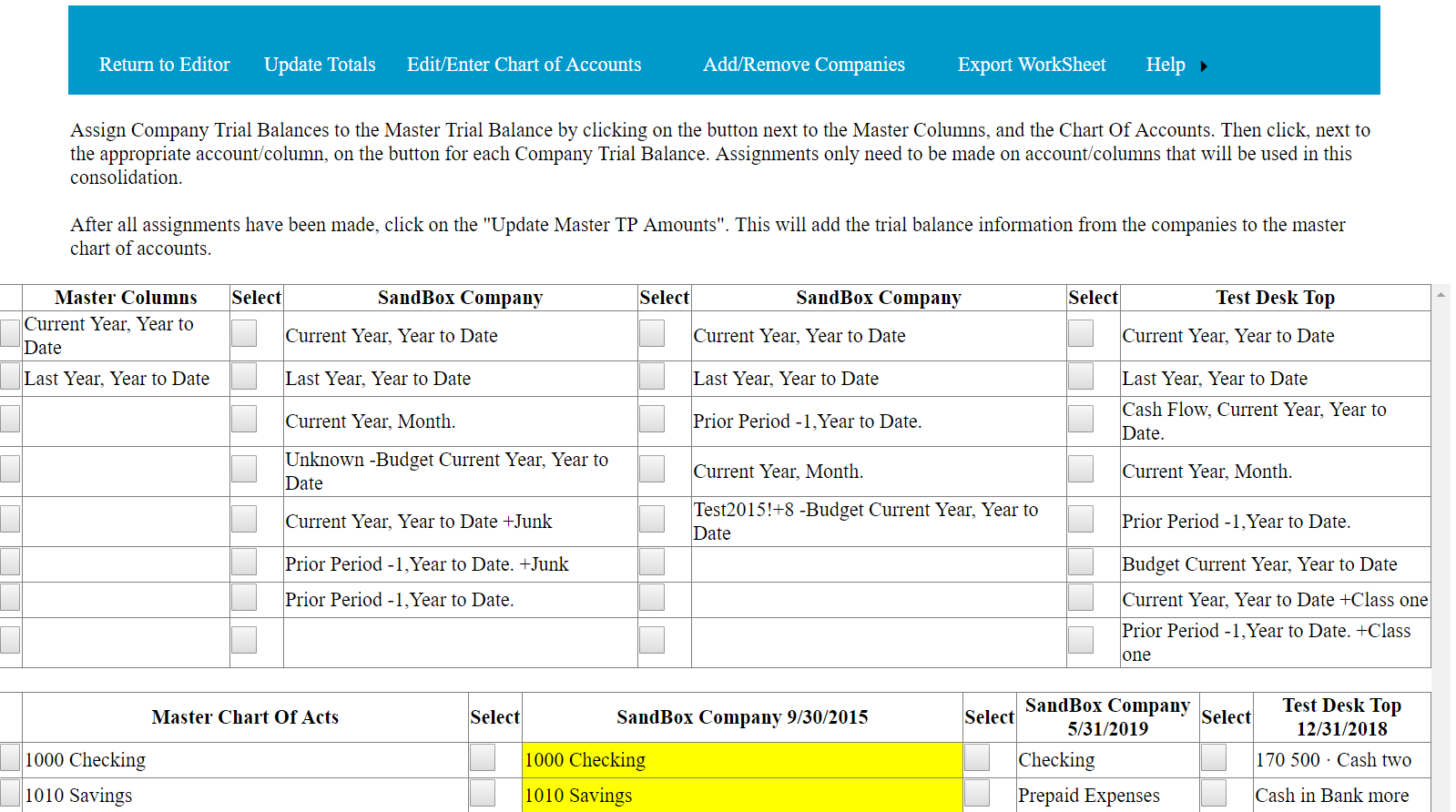

4 Column Chart Of Accounts

4 Column Chart Of Accounts

Income includes all the money you earn, whether it’s from your job, investments, or other sources. Expenses cover all your spending, such as bills, groceries, and entertainment. Assets are things you own, like your house or car, while liabilities are what you owe, such as loans or credit card debt.

Organizing your finances with a 4 column chart of accounts can help you make informed decisions about your money. You can easily see how much you’re making, where you’re spending it, what you own, and what you owe. This clarity can empower you to set financial goals and work towards achieving them.

In conclusion, a 4 column chart of accounts is a simple yet powerful tool to manage your finances effectively. By categorizing your income, expenses, assets, and liabilities, you can gain a better understanding of your financial situation and make informed decisions about your money. Give it a try and see the difference it can make in your financial life!

How To Write An Accounting Ledger with Pictures WikiHow

Chart Of Accounts Template Free Download

How To Build A Better Advisory Firm Chart Of Accounts

Chart Of Accounts For Small Business Template Double Entry