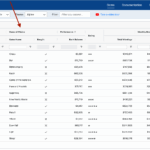

Are you looking for an easy way to manage your finances? 4 Column Chart Accounting might be the solution for you. This method simplifies tracking income and expenses, making it ideal for small businesses or individuals.

With 4 Column Chart Accounting, you can categorize your transactions into four columns: income, expenses, assets, and liabilities. This clear separation allows you to have a better overview of your financial situation and make informed decisions.

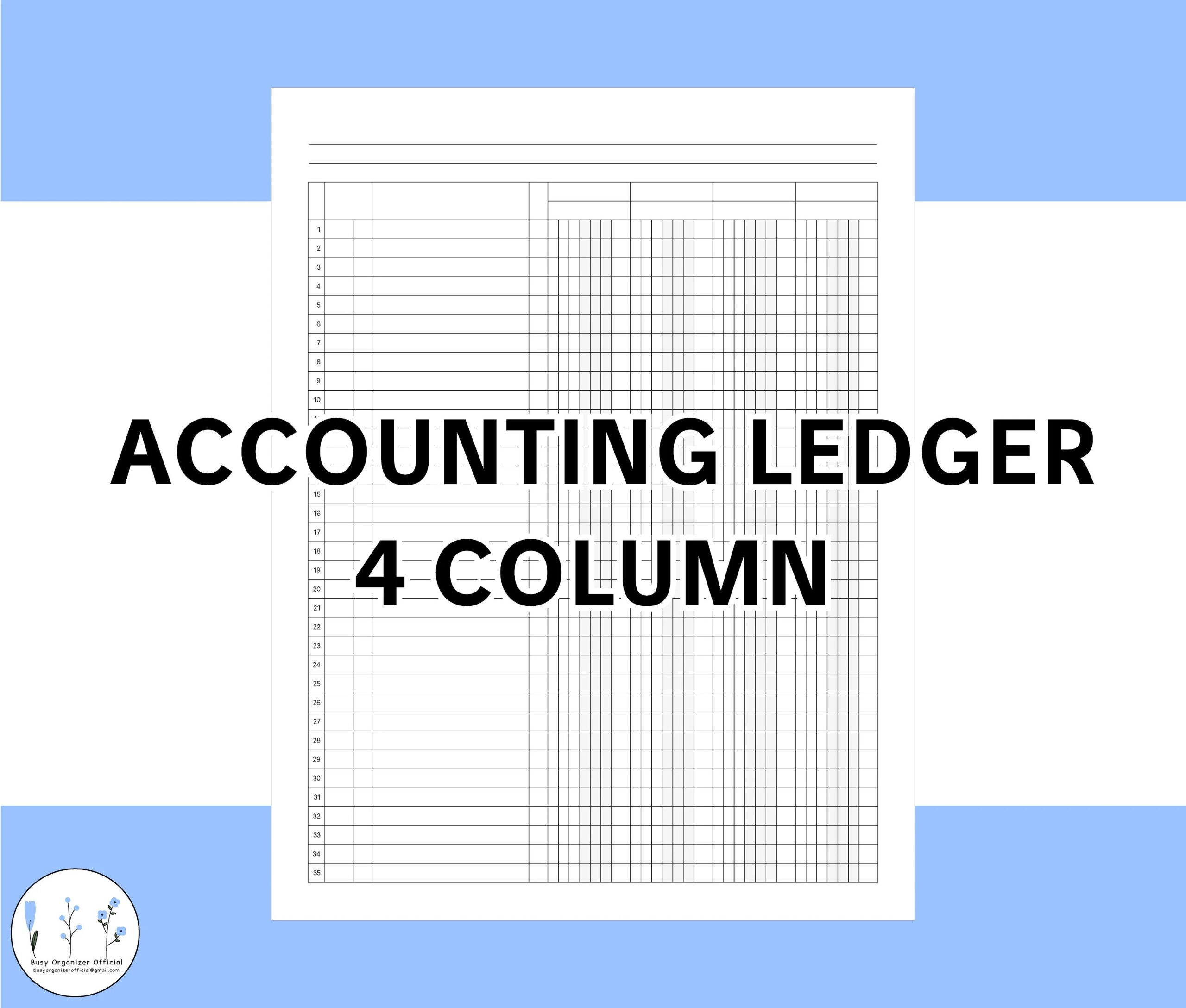

4 Column Chart Accounting

Benefits of 4 Column Chart Accounting

One of the main advantages of using a 4 Column Chart is its simplicity. You don’t need to be a financial expert to understand where your money is coming from and where it’s going. This system is user-friendly and perfect for beginners.

Another benefit is the ability to easily track your assets and liabilities. By having these categories separated, you can see how your assets are growing over time and how your liabilities are affecting your overall financial health.

Moreover, 4 Column Chart Accounting can help you identify trends in your income and expenses. By regularly updating your chart, you can spot patterns and make adjustments to improve your financial situation.

In conclusion, 4 Column Chart Accounting is a simple and effective way to manage your finances. Whether you’re a small business owner or an individual looking to stay on top of your money, this method can help you achieve your financial goals.

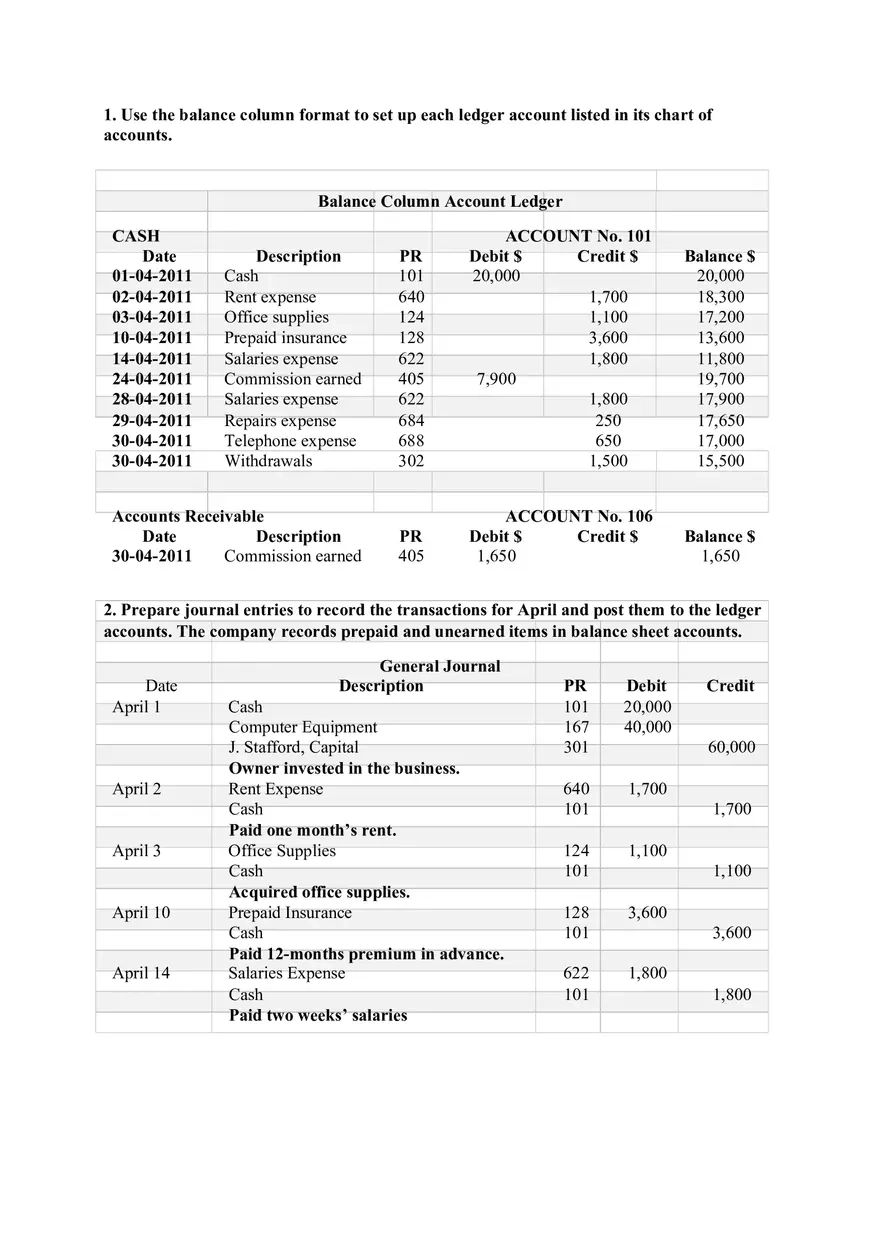

Accounting Homework For Chapter 4 Problem 4 2A Edubirdie

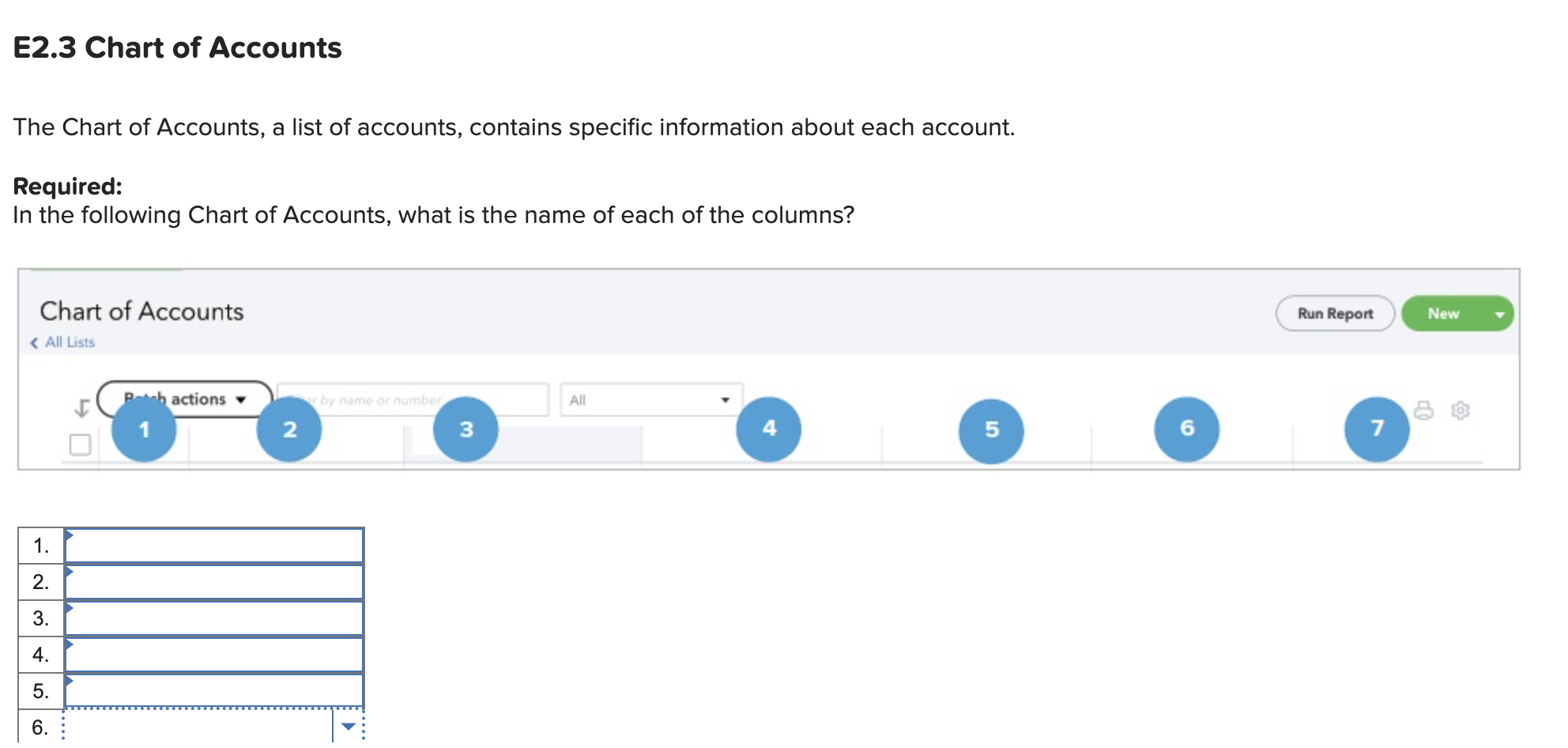

E2 3 UfeffChart Of AccountsThe Chart Of Accounts A List Chegg

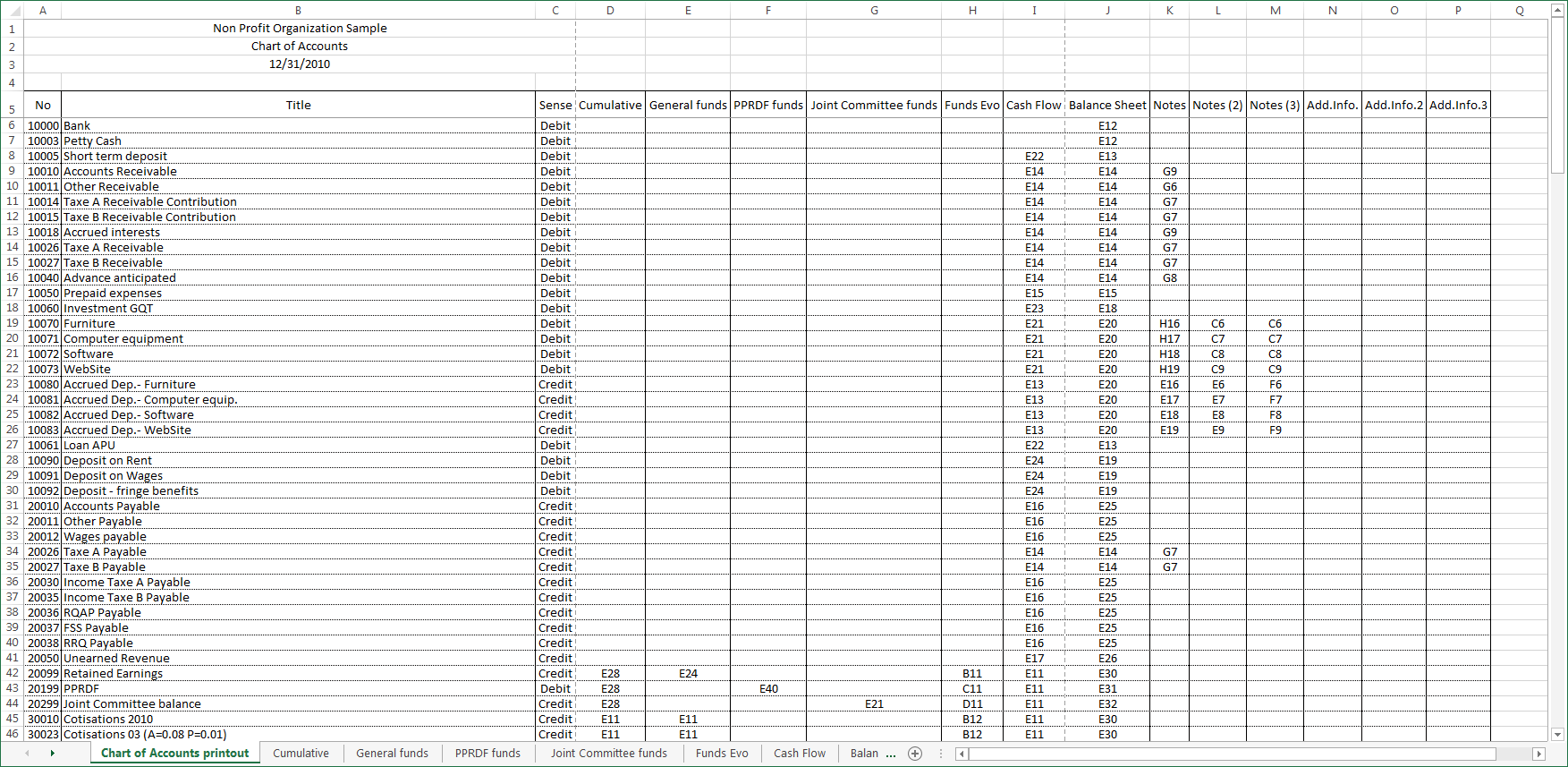

ExcelFSM

4 Column Paper 10 Free PDF Printables Printablee

Accounting Ledger 4 Column Printable Account Ledger Pdf Digital Instant Download Budget Planner For Bookkeeping Etsy